American Banker

By Kate Berry

January 03 2018

The tax reform law enacted late last year is already threatening to exacerbate the affordable housing crisis — and the outlook could be even worse going forward.

The affordable housing market relies heavily on subsidies from two different affordable housing programs: the low-income housing tax credit program, and private activity bonds that allow states and cities to borrow on behalf of private companies and nonprofits to lower their borrowing costs.

Lowering the corporate tax rate reduces the value of the tax credits by roughly 15% because banks and partnerships that use the tax credits are limited in deductions on depreciating expenses, experts said. The tax law is expected to eliminate 300,000 affordable housing units over 10 years in part because it will reduce the value of banks’ low-income tax credits, which finance half of all affordable housing units, according to a report by NHP Foundation, a nonprofit real estate firm.

“Lowering the corporate tax rate to 21% from 35% has a large effect on affordable housing in terms of what investors will pay and what yield they will settle in at,” said Bob Moss, a principal and national director of government affairs at CohnReznick.

Investments in low-income housing tax credits also depend on whether alternative investments are attractive or not. In past years, the tax credits have been in such demand by banks that they have been oversubscribed, but lowering corporate rates could change that dynamic, experts said.

“When you rush something that’s going to amend 60,000 pages of the IRS tax code, the unintended consequences are huge,” said Richard Burns, the CEO of the NHP Foundation. “It’s politics over policy. Congressmen just aren’t interested in affordable housing, they are playing to a base that doesn’t really understand it, or they don’t put enough of a priority on it.”

What is still unknown is how corporate expensing under the new tax law will play out, Moss said. The reduction in the corporate tax rate could reduce the number of banks and corporations that are buyers of the tax credits.

In addition to reducing the supply of affordable housing, the tax law is likely to create more income inequality.

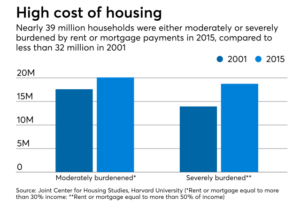

More than 11 million American households now spend more than 50% of their income on rent, according to the Joint Center for Housing Studies at Harvard University.

Demand for affordable housing has spiked to historically high levels as renter households increased by more than 26% to 43 million in the 10 years ended in 2015 — the largest growth rate in any decade in recent history, Harvard found.

That demand has come, however, while supply has dwindled. Last year, hurricanes and other natural disasters helped reduce the supply even further. Additionally, there is a significant amount of affordable housing from the 1970s and 1980s in a deteriorated condition that needs to be rehabilitated, Burns said.

Very little new construction is done with either the tax credit or private activity bond programs.

Advocates also are sounding the alarm because the increased deficits created by the new tax cuts put the National Housing Trust Fund and other vital housing and community development programs at risk of deep spending cuts down the road.

Burns estimates that there is a shortage of 6 million rental units, and predicts that will only get worse.

“It’s not just a problem or an issue, it’s a crisis,” he said.

If rents and income grow in line with inflation, it’s projected that the number of severely burdened rental households will jump 11% to 13.1 million in 2025, from 11.8 million in 2015, according to a report by Enterprise Community Partners and the Joint Center for Housing Studies.

The situation may be even bleaker once Sen. Orrin Hatch, the longtime Republican senator from Utah, retires at the end of the year. Hatch was a champion of affordable housing, and without him Republicans could try to eliminate affordable housing programs down the road, experts said.

For example, Hatch was instrumental in preserving the use of private activity bonds, which became controversial as Republicans targeted their use in financing sports stadiums and toll roads. Businesses typically use tax-exempt private activity bonds to finance airports, hospitals, charter schools and multifamily apartment projects.

Republicans want to pass an infrastructure bill and already have signaled that they are going to want a more efficient use of private activity bonds, Moss said.

“They limited the states from carrying forward an unused bond cap, and that makes me think this is ‘shovel ready,’ when they do pass an infrastructure bill,” he said.

Other tax credits could also be on the chopping block. The just-passed tax law preserves the New Markets Tax Credit, administered by the U.S. Treasury’s Community Development Financial Institutions fund. The credit works by providing an incentive to private investors to put equity into development projects in low-income and distressed markets.

But the credit is due to expire in 2019.

“We intend to begin again our campaign to add co-sponsors, to continue documenting the success of the credit and to work toward permanent authorization,” said Bob Rapoza, spokesman for the New Markets Tax Credit Coalition, a group of more than 2,000 financial institutions, investors and community development partners.

Laura Alix contributed to this article.